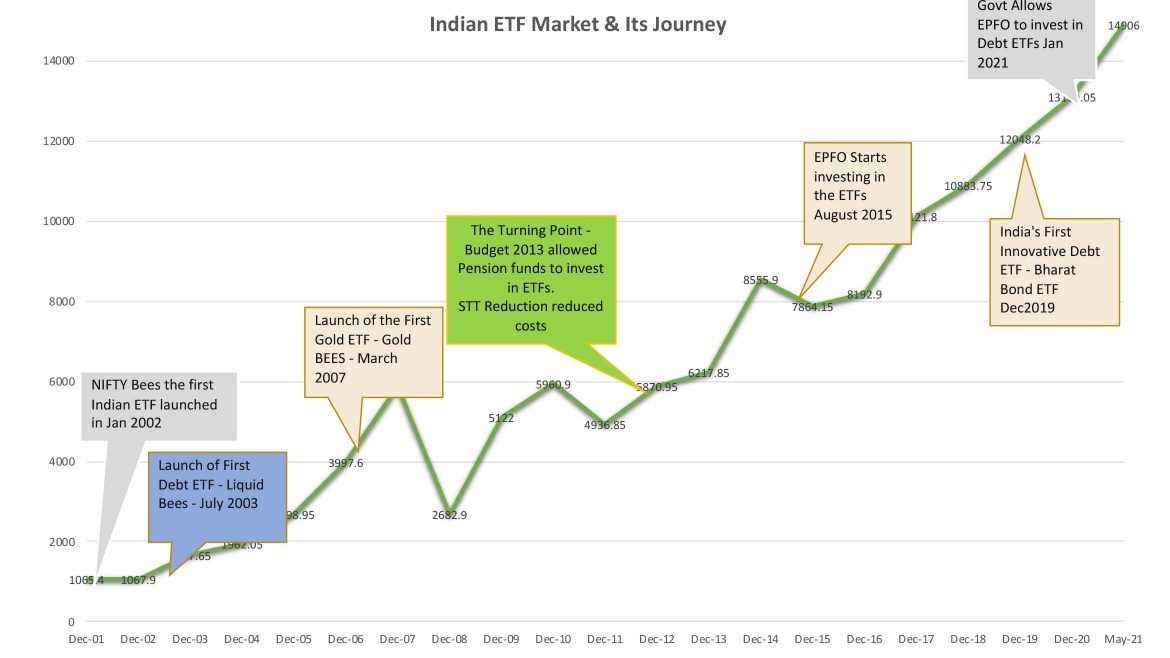

The Indian ETF Industry evolved in the year 2001 with the launch of Nifty ETF (Nifty BEES) by the Benchmark Asset Management. The ETF tracked the Nifty 50 Index.

Later in 2003, the pioneer Benchmark Asset management launched a second ETF -the first debt fund ETF in India – Liquid BEES, which helped the conservative investors tap the money markets.

The First Gold ETF – Gold Bees was launched in 2007 which turned out to be instantly popular with the Indian Investor. The ETF’s popularity surged extensively during 2008-20013. Global market plunge in the year 2008 made the yellow metal popular, in fact, half of the ETF assets during 2009-14 were parked in the Gold ETFs.

The Game changers for the ETF Industry

Entry of the EPFO

The Major Event which changed the Indian ETF Industry is when the government in its budget of 2013 allowed the EPFO – Employee Pension Fund to invest in ETFs. Adding to that the budget also lowered the security transaction taxes to offer ETFs a level playing field with mutual funds

CPSE ETF – The Low cost Disinvestment vehicle

The ETF Industry got a push by the government when the CPSE ETF was announced to disinvest a part of public sector enterprises that constituted the CPSE Index. The ETF was managed by Goldman Sachs Asset management company, which acquired the Pioneers Benchmark asset management company in 2011.

The Government garnered 3000 crores from the First issue. The Product was designed in a way to give an added advantage to the investor while balancing the government objectives of lower cost and minimal market disruption. Additionally, it was designed in a way that provided flexibility to the government for continuous disinvestment over a period of time.

- CPSE ETF March 2014 NFO – 3000 Crores

- CPSE ETF FFO1 Jan 2017 – 6000 Crores

- CPSE ETF FF02 March 2017 – 2500 Crores

- CPSE ETF FF03 Nov 2018 – 17000 Crores

- CPSE ETF FF04 March 2019 – 10000 Crores

- CPSE ETF FF05 July 2019 – 11500 Crores

- CPSE ETF FF06 Jan 2020 – 16000 Crores

The CPSE ETF has been a good avenue for the government to tap the markets for disinvestment and has been successful in getting higher subscriptions from Institutional and retail investors.

Investment in the CPSE ETF may not be the best investment bet as investing in Public sector enterprises has its own pros and cons. But for a conservative investor, it is a good bet as the CPSE ETF portfolio has a good dividend yield compared to the Nifty dividend yield.

Will write a detailed note on the CPSE ETFs with its cost for the investors at various Follow on offers.

Smart Beta ETF

Reliance Mutual Fund launched the R Shares NV20 ETF the first smart beta ETF, which allows investors to invest in the top 20 liquid companies out of the Nifty 50 Universe.

The ETF has currently an AUM of meagre 35 Crs but has been the best performing fund/ETF in the large-cap sector. The ETF has generated a CAGR of 18.33% for a period of 5 years, compared to 16.14% by the best performing Mf – Axis Bluechip Fund.

Bharat 22 ETF

Bharat 22 ETF was launched in Nov 2017. The ETF like the CPSE ETF was a Part of the government’s disinvestment program and follows the S&P BSE Bharat 22 Index comprising of select companies from the CPSE universe, some state-run banks, and companies where the government had stakes under the Specified Undertaking of the UTI (STUTI). It was a diversified index comprising 6 sectors like industrial, banking and financial services, utilities, energy, FMCG, and basic materials.

Retail investors were offered a 3% discount in the NFO. The ETF was subscribed four times the initial size of 8000 crores. The government retained 14500 Crs.

The Second Tranche of Bharat 22 ETF was launched in June 2018 and 8400 crores were mopped in. The Third tranche fetched 13000 crores in Feb 2019 and the Fourth Tranche drew bids of 23500 Crores oversubscribed by 12 times. Govt retained 4368 crores from the offer in Nov 19. ICICI Mutual Fund manages the Bharat 22 ETF.

Bharat Bond ETF – First Innovative Bond ETF

Bharat Bond ETF is an efficient way to buy bonds of Public sector enterprises. Four such ETFs have been launched to date. Every ETF has a fixed maturity date which gives the investor a fair idea of the returns to be expected till maturity. The ETF is a very low-cost product and does not have any lockin, the investor can sell the ETFs in the open market when they wish to do so.

Four tranches of Bharat Bond ETF are launched so far two in Dec 2019 and two in mid of 2020. The ETFs are managed by Edelweiss Mutual fund. More details can be accessed at website https://www.bharatbond.in/

EFPO can Invest in Debt ETFs

The Government recently in a notification dated 4th Jan 21 has allowed EPFO and exempted Provident fund (PF) trusts to Invest in Debt ETFs like Bharat Bond ETFs. The move will benefit the ETF industry with good volumes.

Conclusion

Popularity of the ETFs has taken over the world, AUMs of ETFs in US have surpassed the AUMs of Active Funds. The benefit of low cost and instant liquidity have made them appealing and attractive.

In India the ETF markets is gaining traction slowly. As an Investor I would like ETFs in India to be more popular and liquid.